Record number of calls and internet usage during second wave of pandemic

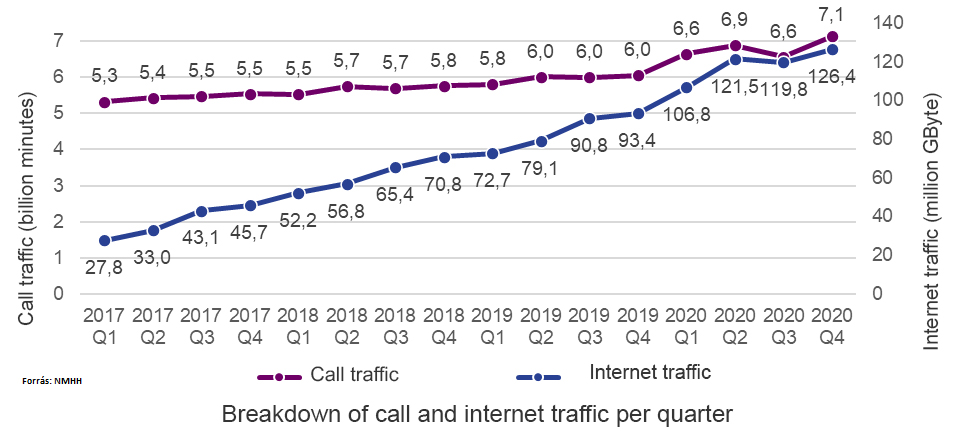

Domestic quarterly mobile internet traffic exceeded 126 million GByte at the end of 2020, compared to less than 100 million GByte a year earlier, according to the latest mobile market report on the the main indicators of mobile telephony, mobile internet and mobile M2M services published by the National Media and Infocommunications Authority (NMHH) yesterday. Domestic voice call traffic increased by 18 percent over one year to 7.1 billion minutes in the last quarter of 2020 compared to the same period last year.

The four operators owning their mobile networks and those that provide services under a network contract with a mobile operator owning a network are required to provide data quarterly for the NMHH’s mobile market report, which is updated with new data every six months. The recent document covers the period from Q1 2017 to Q4 2020.

The report highlights that by the end of 2020 the average monthly data traffic per SIM card increased by 42.8 percent for residential subscribers, and by 12.4 percent for non-residential subscribers compared to the end of 2019. This represents an increase of 35.3 percent over a year for total domestic mobile internet traffic of 126 million GBytes. Phone call traffic also increased by almost a fifth to 7.1 billion minutes, but there was no significant difference between residential and non-residential subscribers. However, the upward trend in roaming services was spectacularly interrupted in 2020, especially from the second quarter. In the fourth quarter of 2020, only one third as many SIM cards were used to make calls and four tenths as many to surf the internet from abroad as a year earlier. At the same time, the average monthly roaming call and data traffic per roaming SIM card increased dramatically: the former nearly tripled from 40.9 minutes to 114.7 minutes, while the latter increased nearly 3.5 times from 0.8 Gbyte to 2.7 Gbyte.

Over the four years under review, the number of SIM cards remained stable, although the number of SIM cards in the mobile market temporarily declined slightly in the first half of 2020. At the end of 2020, the number of activated SIM cards was 11.5 million, while the number of SIM cards in circulation was around 10.6 million. The share of post-paid SIM cards rose from 60.2 percent in the first quarter of 2017 to 69.5 percent at the end of the period under review, at the expense of pre-paid SIM cards. Within the mobile market, the mobile telephony market is saturated, with the number of SIM cards used for calls remaining stable during the period considered at 9.75 million at the end of 2020. 96 percent of total call traffic is from a post-paid subscriptions.

The number of activated M2M (machine-to-machine) SIM cards, i.e. SIM cards used for device-to-device communication without human intervention, increased by ten percent per year to over 1.3 million in the second half of 2020.

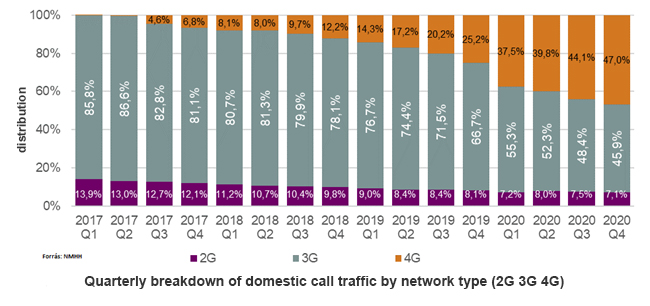

Most voice calls and data traffic are also on 4G

The role of 4G, the fourth generation of mobile services, in voice traffic has been steadily growing, with almost half of all calls – 47 percent – made on 4G networks by the end of the period, compared to 25 percent at the end of 2019. This growth is likely to be driven not only by network development but also by the increasing number of 4G-enabled devices being used by the users. By the end of 2020, 4G call traffic was thus higher than 3G traffic, which was almost 46 percent. 2G networks’ share of voice calls is just over seven percent, down by one percentage point compared to the end of 2019. Domestic mobile call traffic has also increased over the past year, with post-paid subscribers talking on their devices for an average of more than five and a half hours (339 minutes) per month and pre-paid subscribers for more than half an hour, according to Q4 2020 data. Compared to the last quarter of 2019, total SMS sent fell by 18.8 percent by the end of 2020.

By the end of 2020, 95 percent of all domestic mobile internet traffic was carried on 4G networks; 3G accounted for 3.6 percent and 2G for 1.5 percent. Over the last four years, annual mobile internet traffic has more than tripled, exceeding 474.4 million GBytes per year at the end of 2020. Within this, data traffic in the smartphone segment, which accounts for two thirds of all traffic, grew to 87.2 million Gbyte by the last quarter of 2020, an increase of 39.5 percent compared to the same period last year. A smartphone SIM card with a post-paid subscription generated an average of 4.9 Gbyte of data traffic per month at the end of 2020, compared to 1.5 Gbyte per month for a pre-paid SIM card.

DIGI exceeded 2 percent market share for the first time in the history of the report

In the mobile telephony market, Magyar Telekom Zrt. was the market leader in terms of SIM cards used for calls between the beginning of 2017 and the end of 2020, with a share of around 45 percent. Telenor Hungary Zrt.’s share (second place) decreased by 2.4 percentage points during this period, while Vodafone Hungary Zrt.’s share (third place) increased by 0.9 percentage points.

Magyar Telekom was also the market leader in the mobile internet market, with a share of around 41 percent in terms of SIM cards used for internet traffic. Magyar Telekom was followed by Vodafone and Telenor, swapping places several times, with similar market shares of around 28 percent, while by the end of the year DIGI was fourth with almost 2.5 percent of the market.