Due to the coronavirus, we are making more calls and using the Internet more frequently

Due to the coronavirus, there has been an approximately one-sixth increase in calls and one-third increase in Internet traffic in the first half of 2020, coupled with a one-fourth decrease in text messaging compared to the end of 2019 – according to the latest mobile market report published today by the National Media and Infocommunications Authority (NMHH), presenting the developments of the main quantitative indicators of the mobile phone, mobile Internet and mobile M2M services.

The four mobile operators with self-owned mobile networks as well as those providing services based on a network contract with said mobile operators have a quarterly data provision obligation for NMHH’s mobile market report, which is supplemented by new data every six months. The new document covers the period from Q4 of 2015 to Q2 of 2020.

The greatest change in the first quarter of 2020 was that day-to-day life and telecommunications consumer habits were determined by the protective measures against the coronavirus and its spread – curfew restrictions, the introduction of distance-learning and the extensive implementation of home working. An additional market development was the conclusion of the acquisition of UPC, an operator without a self-owned mobile network previously providing virtual services, by Vodafone.

We made more calls and used the Internet more frequently due to the pandemic, while sending fewer text messages

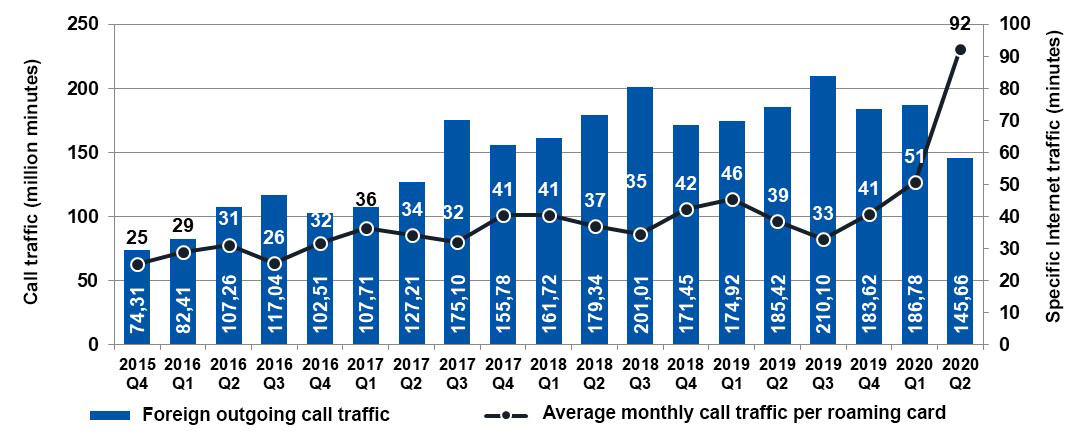

Due to the pandemic, call traffic increased by 13.8 percent and Internet traffic by 30.1 percent compared to the end of 2019. The average monthly call traffic per SIM card increased by 14.9 percent in the case of residential subscribers, while non-resident subscribers – such as businesses – showed a 21 percent increase. Data traffic increased by 41 percent and 10.7 percent, respectively. Conversely, subscribers sent over one-fourth fewer text messages than before. The number of SIM cards with call traffic and Internet traffic stands at 10.4 million, from which the number of post-paid cards increased by 1.6 percent over the last six months to 68.8 percent. The mobile phone service market remains saturated and there has been no significant change in the number of 9.52 million SIM cards generating call traffic. 95.8 percent of the total call traffic was generated from post-paid subscriptions.

The continuous growth of roaming usage has been interrupted by the pandemic

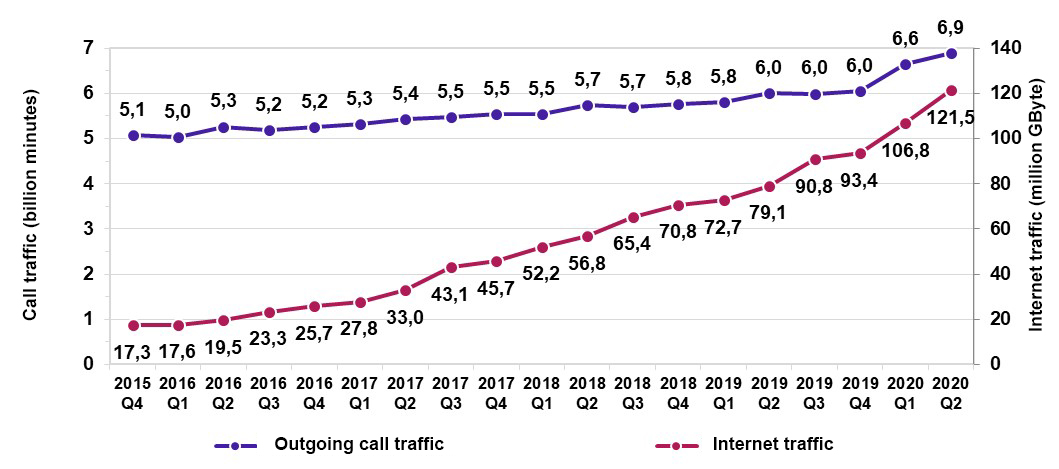

Another impact of COVID-19 is that the continuous increase in roaming, coupled with a seasonal spike in the summer, lost momentum over the period under review: Only 0.5 million foreign outgoing calls were placed in Q2 of 2020, which is less than one-third of the 1.6 million calls placed in the same period in 2019. However, those who did use roaming used it for over twice as long: In Q2 of 2020, the average monthly call traffic per roaming card surged from 39 to 92 minutes – the reason for this being that in general more calls were made from fewer cards. The study shows similar results in the field of foreign mobile Internet use: 570 thousand SIM cards conducted data traffic in Q2 of 2020, which is 40 percent of the 1.4 million measured in the same period of the previous year; in this case, those who used the Internet abroad had a much higher volume of data as the average monthly data traffic per card more than doubled from 0.73 to 1.76 GByte.

4G and M2M use and the distribution of market operators remain practically unchanged

In regards to the domestic Internet traffic by networks, the ratio of 4G usage continuously increased to 96.4 percent until the first quarter of 2020, while Q2 saw a slight decrease to 94.3 percent, yet no far-reaching conclusions can be reached from this data. 4G plays an increasing role in voice traffic as 40 percent of calls were placed through such networks by the end of the period. As far as the rest of the voice traffic is concerned, 52 percent was conducted on 3G networks, followed by 8 percent of the total call traffic on 2G networks.

Based on the number of SIM cards with Internet traffic, Telekom has continuously remained the market leader on the mobile phone service market with a share of 43 percent. This is followed by Vodafone and Telenor with market shares of around 27 percent. In mid-2020, the share of other operators remained practically unchanged at around 2 percent. Based on the number of SIM cards with call traffic, the distribution remains similar, yet within this sector the combined market share of operators without a self-owned network barely exceeded 1 percent in the first quarter of 2020.

The number of M2M SIM-cards – those which are related to inter-machine communication, requiring no human interaction – is still at over 1.2 million, with a slight decrease towards the end of the period under review. The document is available in its entirety on the NMHH website.

Quarterly development of call and Internet traffic

Quarterly specific development of foreign outgoing call traffic and Internet traffic