NMHH: Over a three-year period, the data traffic of mobile internet services has quadrupled

For the first time, the National Media and Infocommunications Authority (NMHH) has published its renewed mobile phone market report presenting the developments of the main quantitative indicators of the mobile phone, mobile internet and mobile M2M services. The document covering a three-year period shows that the number of those who employ mobile internet services has increased by 37%, whilst the data traffic of users has increased more than fourfold. By the end of the period, the 4G networks became the main source of data traffic, whilst thanks to the elimination of roaming surcharges in mid-2017, we tend to use our mobile phones abroad with increasing frequency.

The NMHH compiled the mobile phone market report based on the obligatory, quarterly reports of three service providers with self-owned networks as well as nine other service providers who offer services based on an agreement with a service provider with a network. The authority will update the report every six months. The full report is available on the NMHH website.

The mobile phone service market is saturated; the role of prepaid subscription shows continued decrease

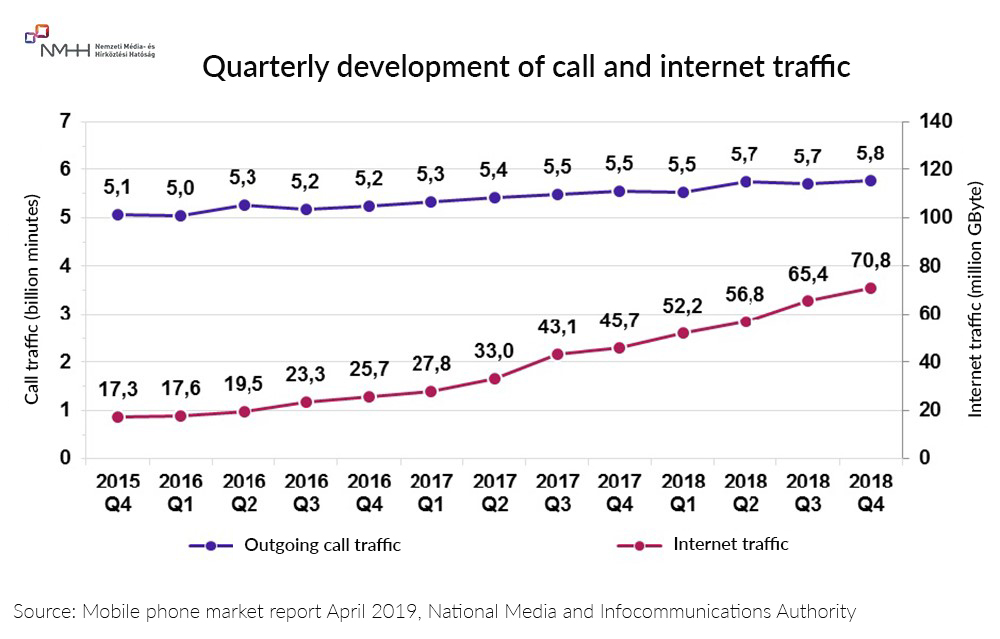

The report shows that there has been no significant change in the number of 11 million users of mobile phone services between 2015 and the end of 2018 and even the outgoing call traffic showed only a slight - 11.9 percent - increase. The role of prepaid subscriptions is increasingly limited on the market: whilst at the beginning of the period, 43% of subscriptions belonged to this category, by the end of the period their share decreased to 36%. The traffic share of the prepaid segment was far more limited (around 5%), which is due to the fact that prepaid users conduct far less traffic than post paid subscribers: there is a tenfold difference between the average monthly traffic of a single subscription between the two types of subscriptions.

The mobile internet service market has significantly expanded, which is mostly due to the smartphone segment

The number of SIM cards with internet traffic has increased by 37% between 2015 and the end of 2018, while the data traffic of users has more than quadrupled over the same period. The number of cards belonging to the smart phone segment of the market has increased by 40% between 2015 and the end of 2018, to over 6 million cards, which by now makes up over 90 percent of all mobile internet cards. The large-screen segment of the market – in which subscribers typically utilize mobile internet services on a computer or tablet – consisted of a stable amount of nearly half a million SIM cards. At the end of 2018, the monthly internet traffic per SIM card of the large-screen segment was 19.37 GByte, while the users of the smart phone segment only yielded one-eighth of this amount, with an average monthly traffic of 2.41 GByte. Due to the difference in traffic, the large-screen segment’s share of the total data traffic was still around 37 percent by the end of the period.

Voice traffic is predominantly conducted over 3G, while data traffic over 4G networks

The majority of domestic outgoing call traffic – four-fifths of calls – was conducted over the 3G networks of mobile operators, with a smaller amount conducted over 2G and 4G networks. 4G networks played a dominant role in conducting data traffic by the end of the period: whilst a little over half of the mobile internet traffic was conducted over 4G networks at the end of 2015, by the end of 2018, the data traffic share of 4G networks increased to over 90 percent.

Roaming has become more popular

Thanks to the elimination of EU roaming surcharges in mid-June 2017, both the number of SIM cards used abroad and the call and data traffic conducted over said cards increased significantly compared to previous years. It was particularly noticeable that after the third quarter of 2017, the number of cards conducting data traffic abroad nearly doubled, whilst the traffic quadrupled.

No significant change in market shares

The market shares measured based on the number of SIM cards with call traffic and internet traffic showed no significant change over the last three years. Magyar Telekom is the leader of both the mobile phone and mobile internet service markets (with a share of around 45%), whilst there is only a minor difference between the shares of the second and third operators (Telenor, Vodafone). Service providers without a self-owned network collectively represented less than one percent.

M2M continues to spread

The number of M2M SIM-cards – those which are related to inter-machine communication, requiring no human interaction – showed a 10-15 percent annual increase and reached an amount of over 1 million cards by the end of the period.